Effective yield calculator

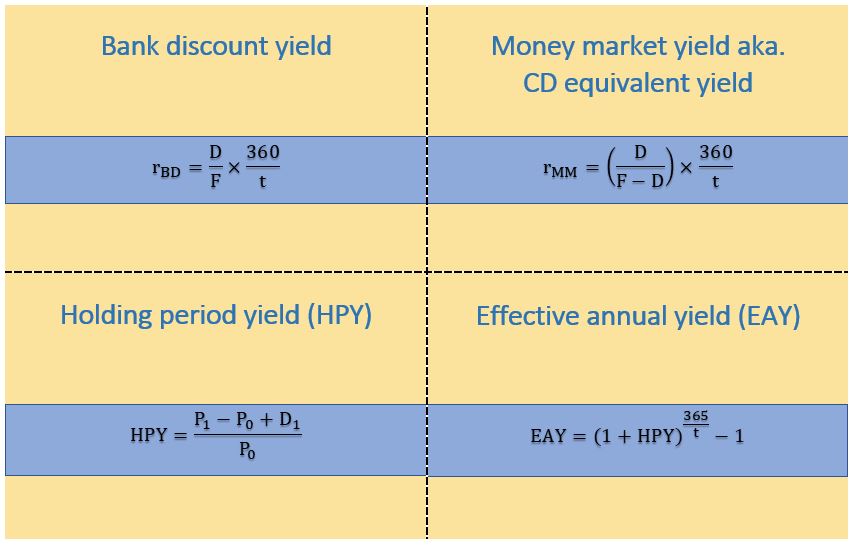

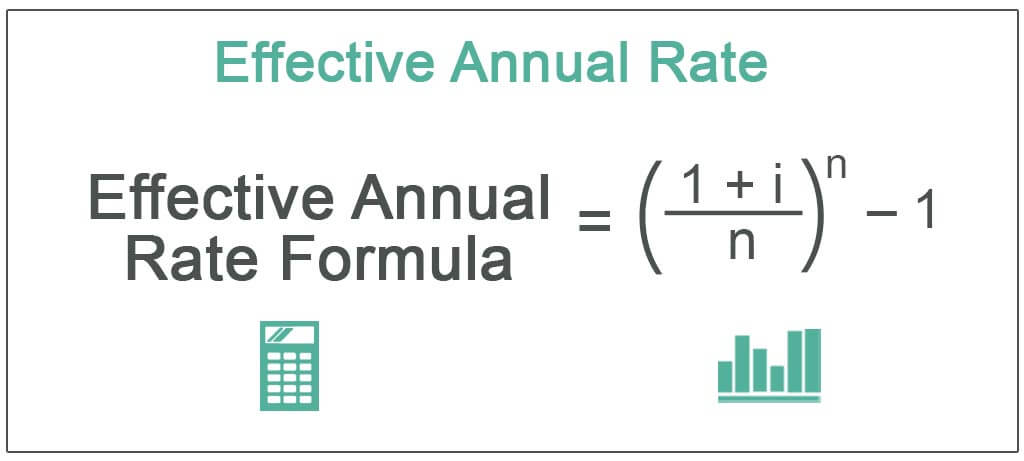

The APY Calculator is a tool that enables you to calculate the actual interest earned on an investment over a year. Effective Yield Formula The formula is provided below.

Bond Equivalent Yield Formula Calculator Excel Template

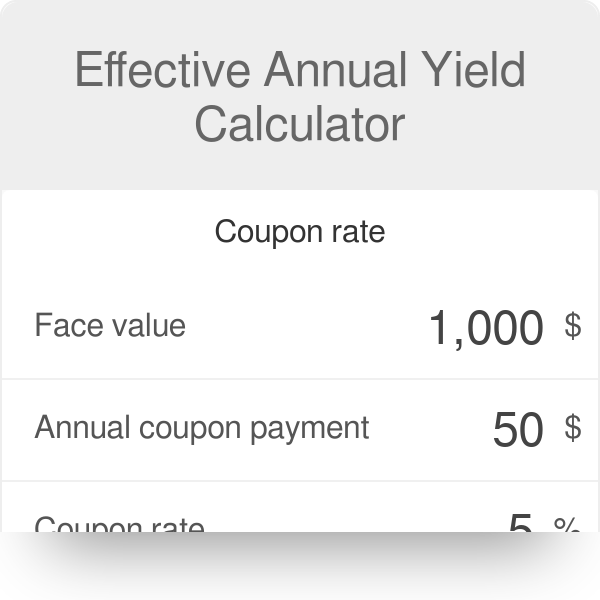

On this page is a bond yield calculator to calculate the current yield of a bond.

. The formula for calculating the effective yield on a discount bond or zero coupon bond can be found by rearranging the present value of a zero coupon bond formula. Home Finance Interest And Deposit. Effective annual yield 1 rnn 1.

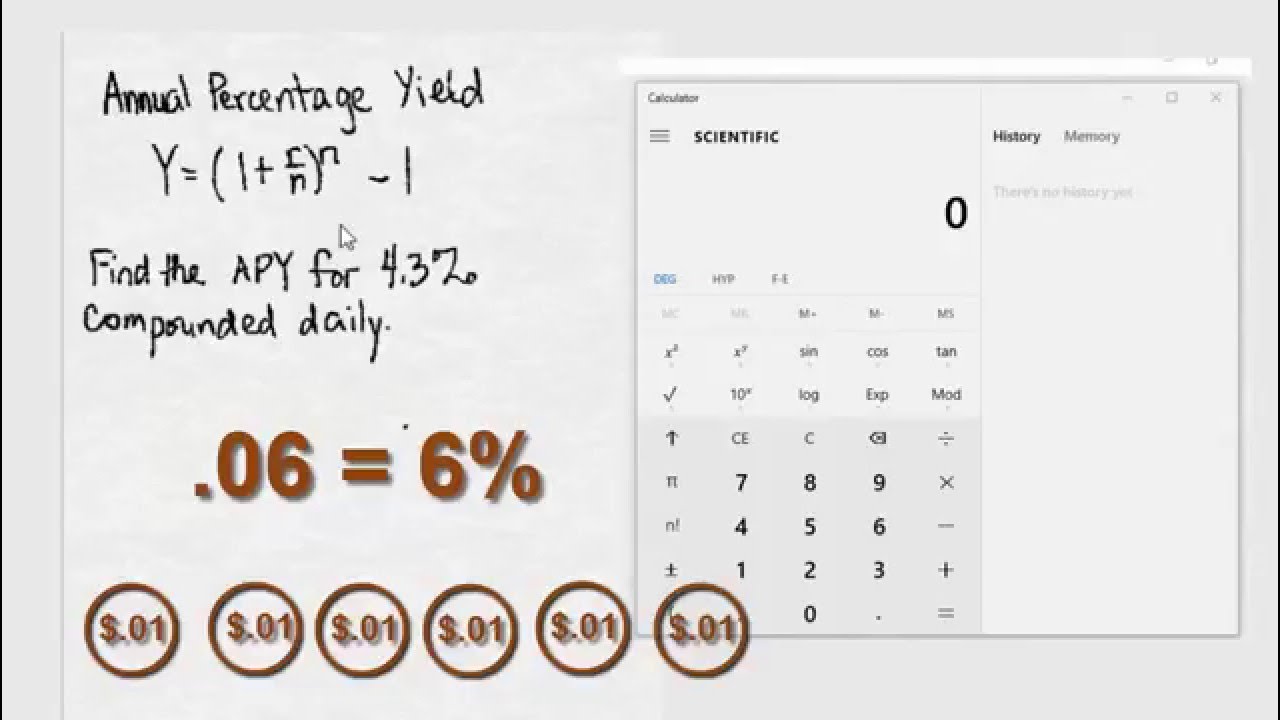

Effective Yield Calculator Q. Annual percentage yield APY is the effective annual rate or real rate of return of an investment if the interest earned each period is compounded. Use this calculator to determine the.

Annual interest yield APY is a measurement that can be. Use this calculator to determine the. Effective Yield Formula 1 rnn 1 Here r represents a nominal rate and n represents no.

The calculator uses the following formula to calculate the current yield of a bond. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. Effective Yield Calculator.

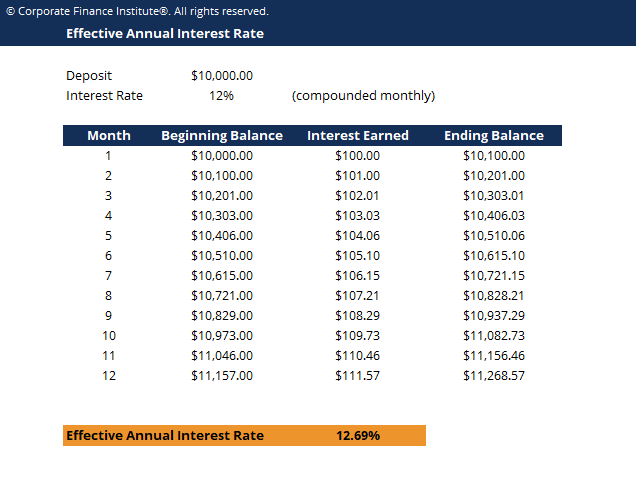

Thus we can see as the compounding. APY considers the effects of compounding. Therefore EAY 00834 or 834.

Of payments received annually. This formula can be. Effective yield is the total yield.

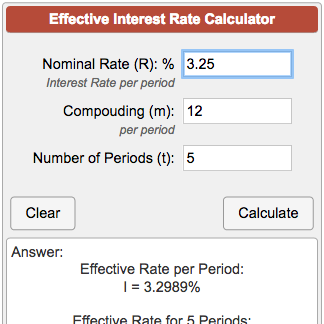

This calculator calculates the effective interest rate using. This tax equivalent yield calculator will estimate the tax-equivalent yield or TEY for a municipal bond. Posted by Dinesh on 26-06-2021T0748.

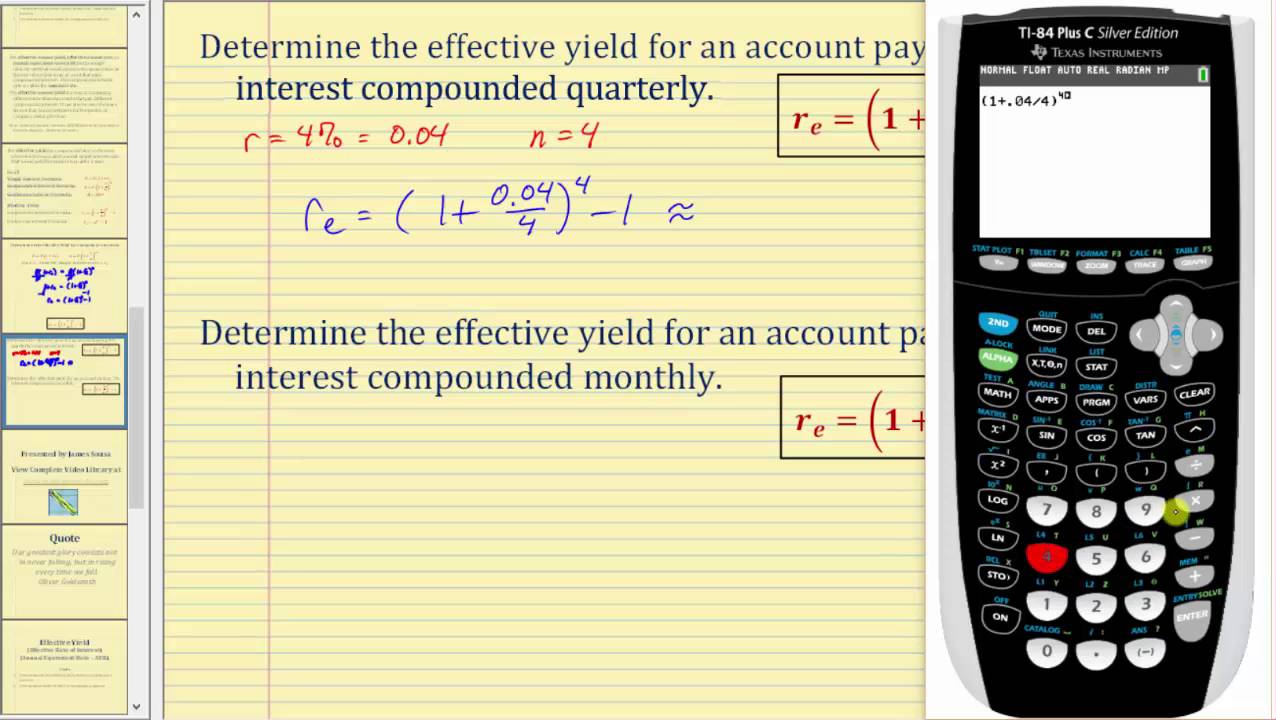

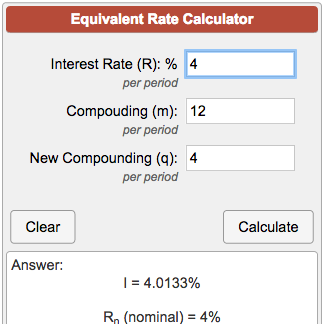

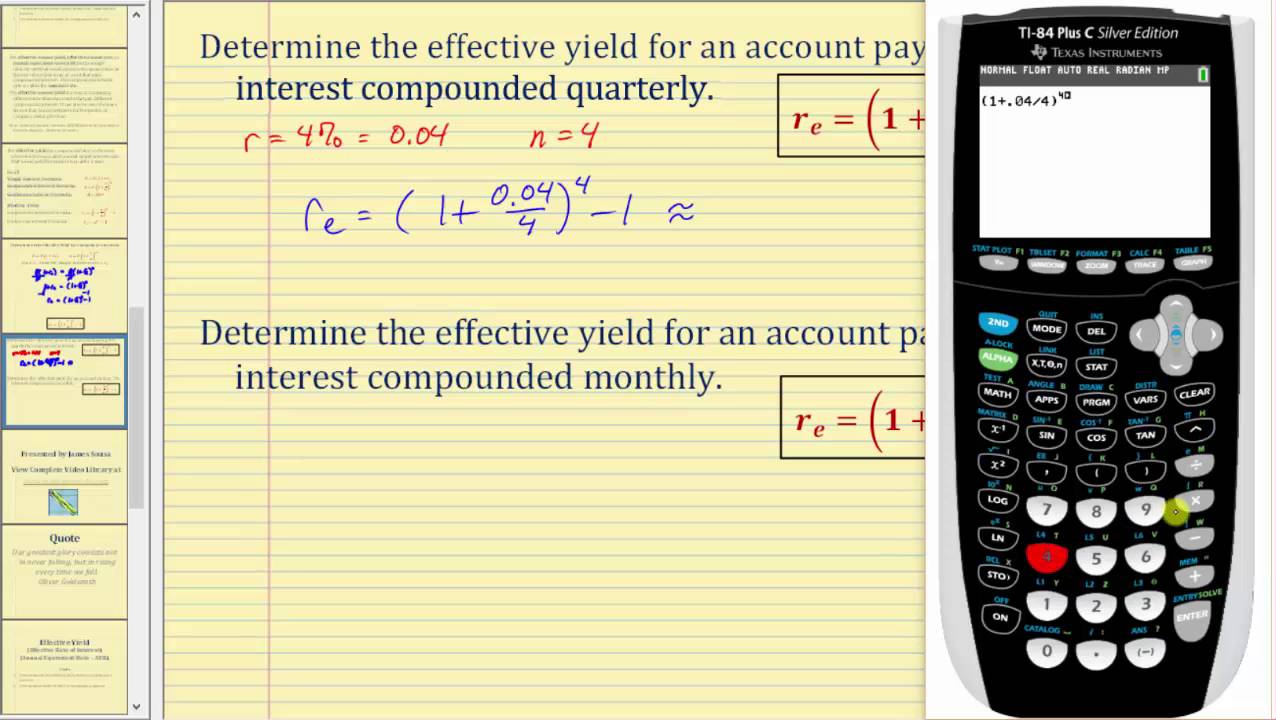

At 724 compounded 4 times per year the effective annual rate calculated is i 1 r m m 1 i 1 00724 4 4 1. For example if an investment compounds daily it will earn more than the same investment with the same statednominal rate compounding monthly. Number of payment periods in one year.

Income generated from municipal bond coupon payments are not subject to federal. CY C P 100 or CY B CR 100 P. And thats why we have built this calculator for you.

This yield to maturity calculation involves complex iteration and it is nearly impossible to do it by hand. Effective annual yield 1 812 12 1 1 000667 12 1 10834 1. CY is the current yield C is the periodic coupon payment.

Nominal annual interest rate. Send This Result Download PDF Result. What will be effective yield to my Deposit.

Using the effective annual rate calculator you can find the following. Yield to maturity YTM is similar to current yield but YTM accounts for the present value of a bonds future coupon payments. For example if an investment compounds daily it will earn more than the same investment with the same statednominal rate compounding monthly.

In order to calculate YTM we need the bonds current price. The effective yield is the yield of a bond which has its coupons reinvested after payment has been received by the bondholder. For Bond A the.

By giving inputs to following parameters DEPOSIT DETAILS Rate of Interest Deposit period in.

Effective Annual Interest Rate Calculator Download Free Excel Template

Bond Yield Calculator

Effective Annual Yield Calculator Calculator Academy

Ba Ii Plus Nominal Effective Rate Conversions Youtube

How To Calculate Effective Interest Rate 8 Steps With Pictures

Effective Annual Yield Calculator Flash Sales 60 Off Www Ingeniovirtual Com

Equivalent Interest Rate Calculator

Current Yield Formula Calculator Examples With Excel Template

Effective Annual Yield Calculator Discount 53 Off Www Ingeniovirtual Com

Effective Annual Yield Calculator And Formula

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Yield For Compounded Interest Youtube

Annual Interest Rate Calculator Sale Online 53 Off Www Ingeniovirtual Com

Effective Annual Rate Ear Definition Examples Interpretation

Bond Yield Formula Calculator Example With Excel Template

Effective Annual Interest Rate Calculator Store 50 Off Www Ingeniovirtual Com

Effective Interest Rate Formula Calculator With Excel Template