Home loan income tax benefit calculator

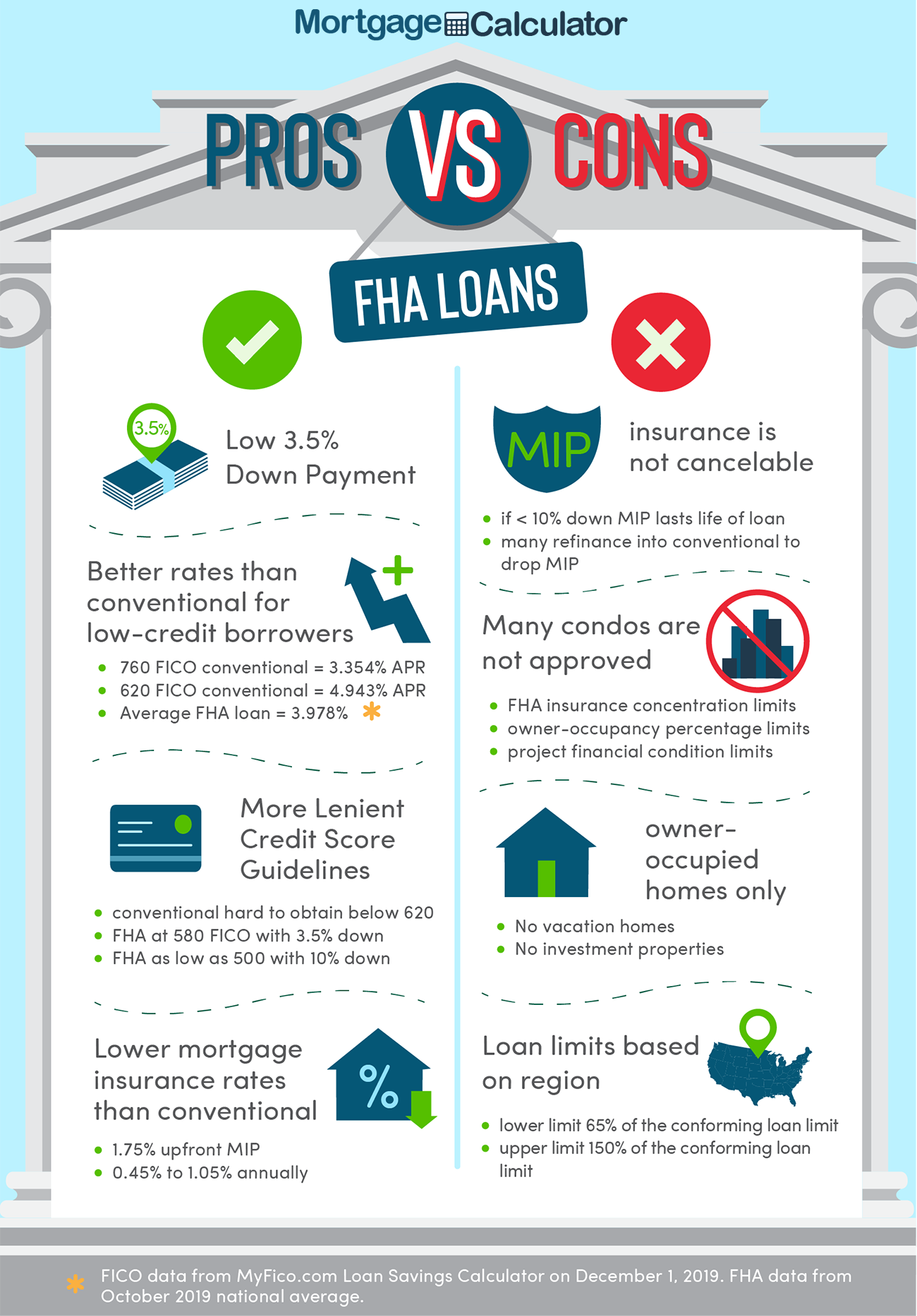

FHA loans are mortgages insured by the Federal Housing Administration the largest mortgage insurer in the. To know your benefits via a home loan tax saving calculator simply follow these 3 steps.

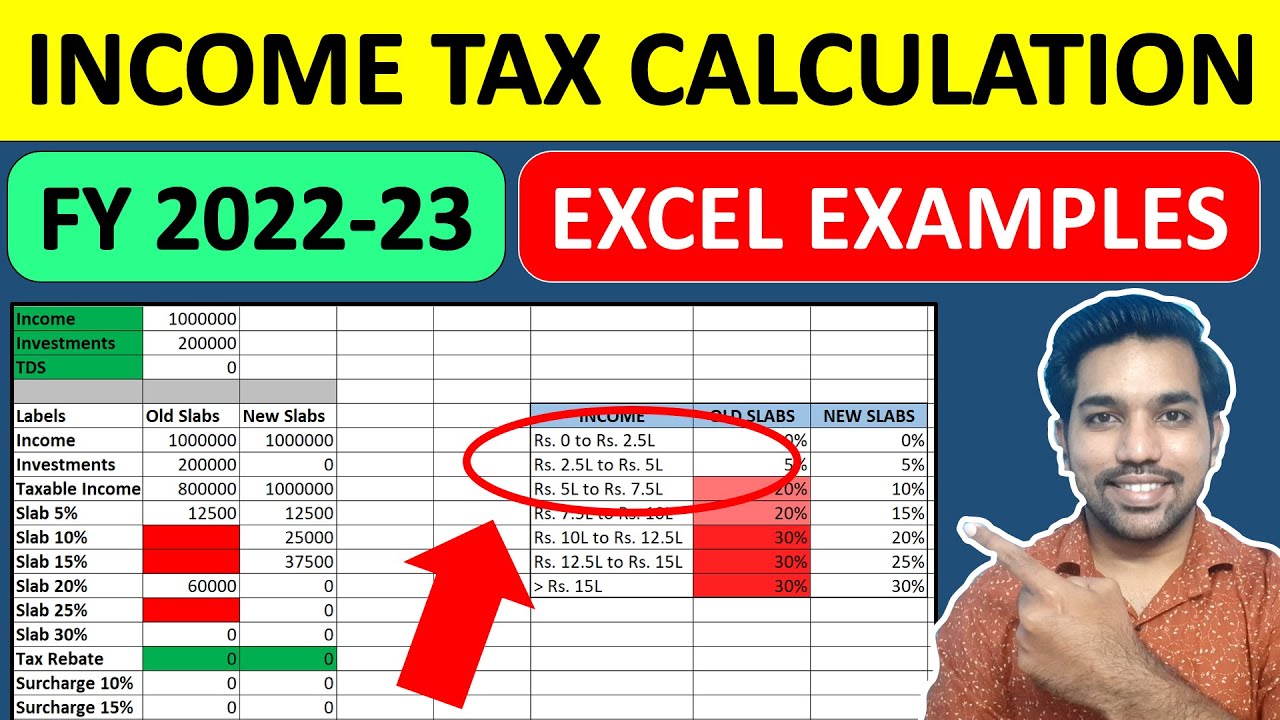

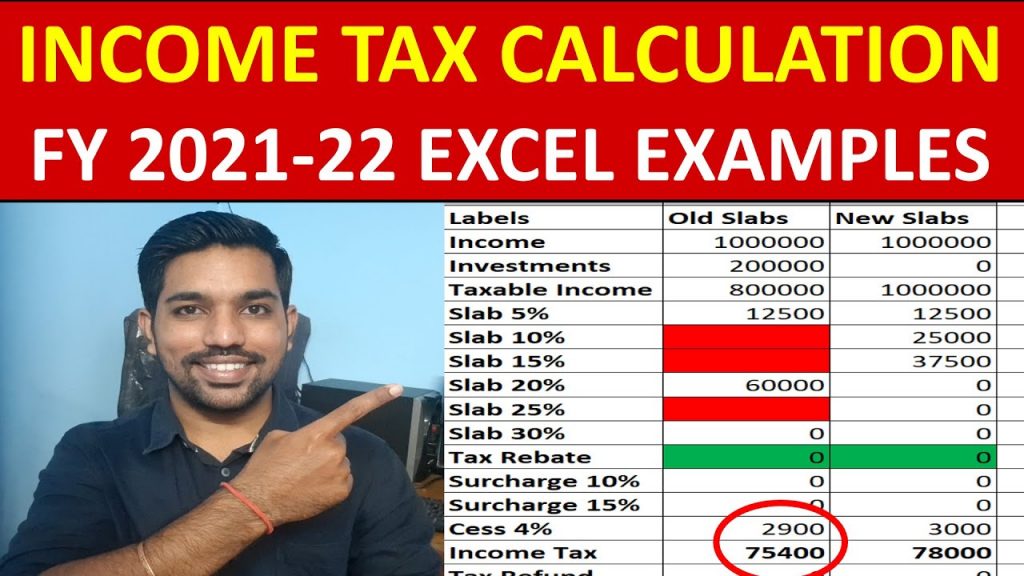

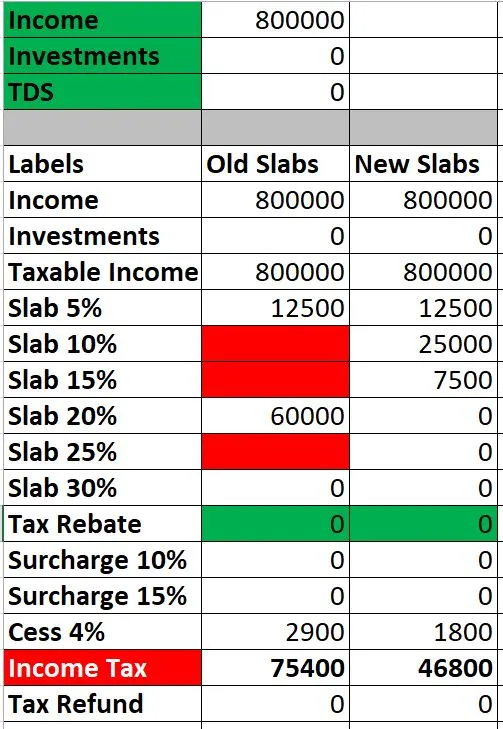

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

. The type and amount of income tax deduction available against repayment. Ad Top Home Loans. Tax Saving Calculator Home Loan Tax Saving Calculator Income Tax Saver - ICICI Bank Use ICICI Bank Tax Saving Calculator to find out how much tax you can save while applying for a.

Meanwhileyou can easily calculate your Tax Benefits on Home Loan EMI by using any online EMI calculator. For your convenience current Redmond mortgage rates are. By providing basic parameters such as the total.

A home loan will help you save tax as per the provisions of the Income Tax Act 1961. Being an automated tool the calculator weighs in all the elements to calculate the amount such as gross annual income home loan interest rate principal amount home loan EMIs existing. Just plug in the amount of the loan your current.

The home loan tax benefi t is enjoyed on the home loan principal amount. It will also show you how much. Our Tax Savings calculator helps you understand the benefit on income tax before and after taking a home loan.

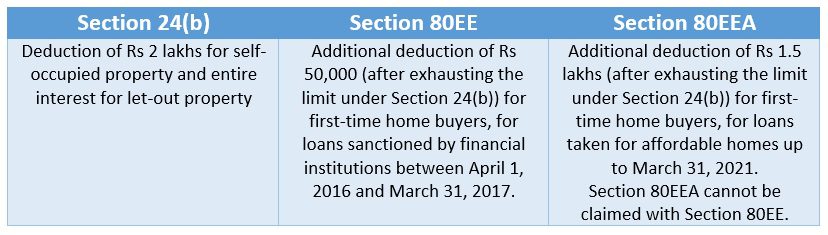

Home Loan Tax Benefit Calculator Income Tax Home Loan Benefits Deductions Exemptions 2022-23In this video by FinCalC TV we will see Home loan tax benefi. Our home loan tax benefit calculator enables you to get an estimate of the amount of tax that you can save by claiming deductions as per the Income Tax. Income tax Benefits You can claim interest as a tax deduction under Section 24 It.

Buying a house on a loan comes with several tax benefits that help in reducing tax outgoings. Moreover you can get tax benefits on your home loans that will help you save a lot of. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home.

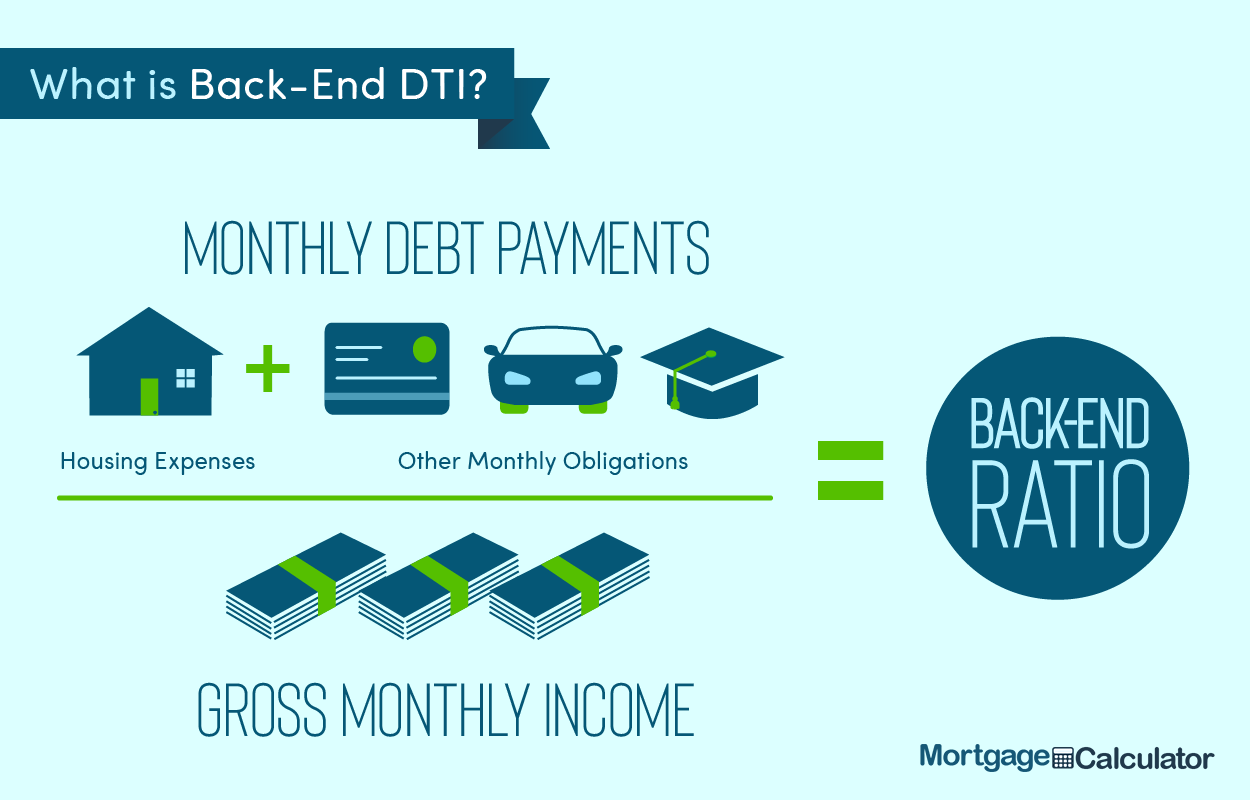

When it comes to calculating affordability your income debts and down payment are primary factors. Tax Benefits This calculator will help you to estimate the tax benefits of buying a home versus renting. Besides if the property is not sold within five years you can avail of a tax rebate of up to INR 15 lakh on.

Interest Reduction on Home Loan. How much loan do you need. Home Loan Tax Benefit Calculator This calculator will help you to estimate the tax benefits of buying a home versus renting.

Employees and employers typically pay half of the 124 Social Security 145 Medicare benefit each for a total of 153. Select Financial Year FY 2020-21 FY 2021-22. First choose the applicable customer type.

Determine monthly payments and loan possibilities on country homes and land. 15 Lakhs on the home loan Principal paid under section 80C. Ad Apply online for a home or land mortgage loan through Rural 1st.

A home loan or housing loan tax saving calculator is an online tool that can help you compute the total tax savings on taking a home loan. Factors that impact affordability. Interest rate PA Tenure years What is your annual income.

Ad Discover Helpful Information And Resources On Taxes From AARP. Self-employed people pay self-employment taxes which had them. Home Loan Tax Benefits Under Section 24 b Under the Section 24 b of the Income Tax Act you can claim income tax deduction of upto Rs 2 lakh on the interest payments on your home.

This simple home loan tax benefit calculator will help you determine the tax saving opportunity that you can be eligible for on your home loan. Regular or Senior citizen Then enter your gross annual. The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Keep in mind that you can claim tax. A home loan tax benefit calculator is an online tool that allows you to compute how much taxes you can save because of your housing loan. To see what will be your income tax exemption on housing loan use the calculator.

How much house you can afford is also dependent on. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Hud income calculator 2021.

A housing loan is initiated if you are buying or purchasing or. Total Income Tax Benefit 105000.

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Tkngbadh0nkfnm

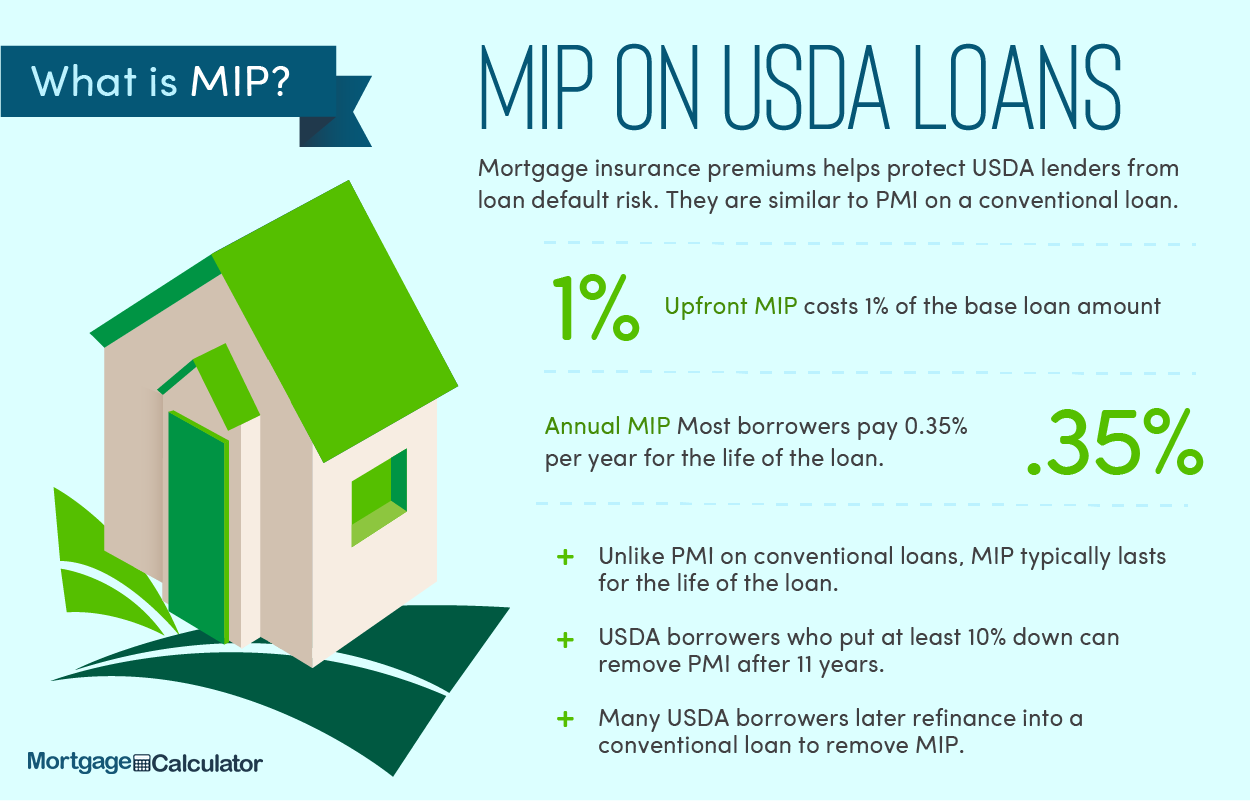

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

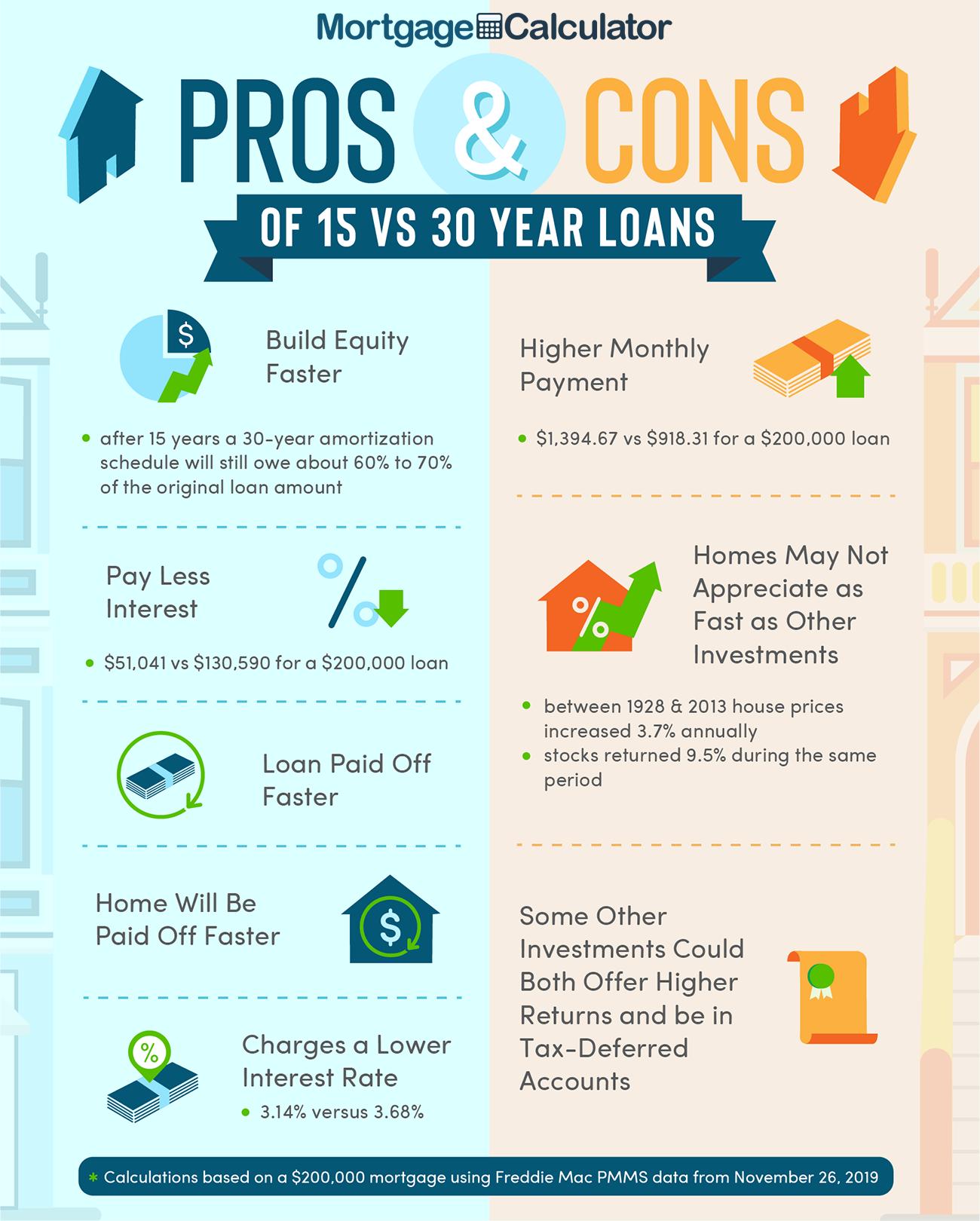

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Section 80ee Deduction For Interest On Home Loan Tax2win

80eea Deduction Eligibility Rebate Applicability Period Total Benefit

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Itr Filing Is It Wise To Pay Home Loan Emi And Avoid Income Tax Outgo Mint